At Holloway Credit Solutions, we approach everything we do with the same commitment to integrity that has allowed our company to grow into the industry leader that it is today.

Our best-in-class technology and expertise allows us to accelerate cash flow and increase recovery while managing our clients’ portfolios within the guidelines of their policies and procedures and those of different payors. We represent our clients within the framework of their organization, effectively resolving accounts in a way that is consistent with their procedures and sensitive to their position in the market.

Holloway has led the way in discovering and developing new technologies to help our clients meet their goals. The result is a comprehensive package of products and services that enables clients to limit their risk and maximize return, while operating in a safe and secure environment. Holloway places a knowledgeable and professional staff at your disposal. We work with you to ensure that you receive the most from the tools we offer. Holloway maintains a high level of accountability to guarantee your success.

History

Scroll through Holloway’s history by clicking each event circle, using the forward and back arrow buttons on your keyboard, or swiping left and right on your touch screen.

-

(1 ⁄ 9)

1900

Holloway Credit Solutions, LLC (Holloway) was originally founded as the Credit Bureau of Montgomery by John M. Holloway, a pioneer in the establishment of the credit reporting industry.

-

(2 ⁄ 9)

1910

In partnership with our customers, we opened offices around the South. Credit Bureaus created their own currency used to trade information!

-

(3 ⁄ 9)

1964

Holloway became the first collection agency in Alabama in 1964, the same day as allowed by law in an effort to provide customers with additional sources of information.

-

(4 ⁄ 9)

1964

Holloway began servicing hospitals in its local service areas with their collections needs.

-

(5 ⁄ 9)

1972

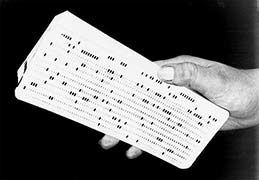

Holloway became the first automated credit bureau in Alabama, teaming with TransUnion.

-

(6 ⁄ 9)

1979

Holloway became the largest privately held affiliate of Equifax in 1979 and became the premier provider of credit related information in the Southeast until 2003.

-

(7 ⁄ 9)

1981

Holloway automated its collection service division, beginning an era of being on the forefront of the collection industry in both customer service and the application of new technologies.

-

(8 ⁄ 9)

1997

Account Management Services, LLC (AMS), a wholly owned subsidiary of Holloway, formed in response to an overwhelming need in the healthcare community for third-party payor and patient collection services that approach recoveries from a client-based, first-party perspective.

-

(9 ⁄ 9)

2013

Holloway launches its own proprietary 270/271 batch eligibility engine with a direct connection to several major payers, ensuring no health insurance coverage goes undiscovered for our clients.

Process

At Holloway, we integrate our system into yours, and our process into your workflow. From the day your business loads into our system, we work to protect you while maximizing recovery of your revenue, all without burdening your staff. We verify accounts not only for accuracy, but also for bankruptcies, deceased accounts, assets, and contact information. Our certified personnel and systems are dedicated to seamless recovery, minimizing the impact on your staff and compliance operations. From reporting and reconciliation to government compliance, our process is our advantage. It’s what we know.

Affiliations

As an organization that believes in continuous learning and improvement, Holloway recognizes the importance of being actively involved in industry-related affiliations. These organizations allow us the opportunity to stay informed, connect with partners, and enhance performance through education and resources.